Turkey’s CBI / CIP program has clear advantages:

- Full rights of a Turkish citizen to public health care, education, and pensions;

- No requirement to speak the language;

- No requirement to spend any time in the country;

- No financial disclosure requirements;

- No taxation on world wide income for a Citizen that does not reside in Turkey for more than 6 months in a 12 month period;

- Advantaged Residency Pathways to UK and USA;

- Cheap Convenient International Air Travel Hub; Visa Free Travel to 140 Countries.

Application & Approval Risks are Low, or Zero:

Investors Recognize Risks & Reality

Turkey Caught in the Middle of a Changing World

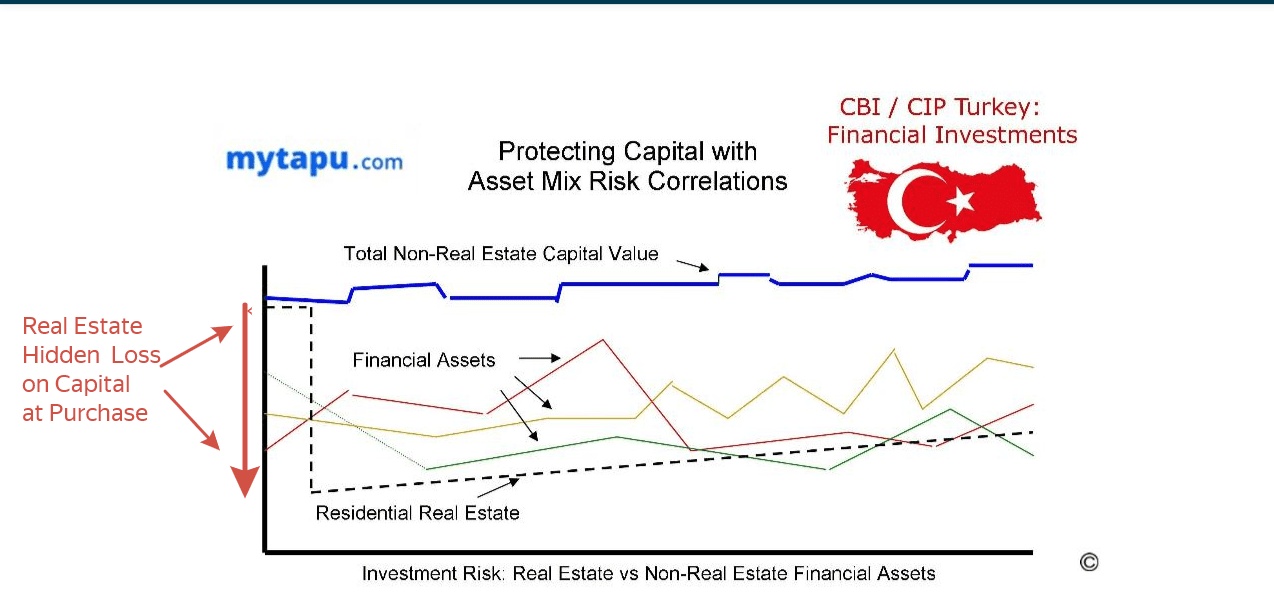

Real Estate has Proven a Poor Investment

Real Estate is the Most Costly Choice

Not Just Turkey- Risks Increasing World Wide

First Priority: Wealth Preservation

Manage Risks and Protect Capital

Financial Assets are the Least Costly Choice for Turkey’s CBI / CIP

- Bank Deposits

- Government Bonds

- Venture Capital Funds

No Turkish Lira Exchange Rate Risks

Protecting the Purchasing Power of Capital

In conclusion, Turkey’s CBI / CIP program offers the great advantages of:

Learn more by email to info@mytapu.com with the subject line

'CBI Financial Assets' and include a WhatsApp or Viber number to receive a complimentary call back…

Advising and Transacting more than $5 billion in Investments in Turkey for more than 3,000 International Investors

since 1989...

Additional Reading for Turkey's CBI / CIP Investors:

Investment Performance of Turkish Assets During Crisis

Additional Reading for Residential Real Estate Buyers:

Residential Property Investors Tool-Kit for Turkey

Property Finders Service Istanbul and Coastal Turkey,

Citizenship Investment in Turkey

The One Source for Every Turkish Mortgage

Legal Services for Property Matters in Turkey

Advice for Property Matters in Turkey

Property Price Histories in Turkey

Why Istanbul Lifestyle Retains its Allure for Real Estate Investors…

What a Good Property Investment in Turkey Looks Like...

How to Find Property to Buy in Turkey?

Mytapu.com: Why is it ‘The Safe Way to Buy’ Property in Turkey?

The Smart Way to Find the Best Property Deals in Turkey

How to Buy Property in Turkey for a Bargain...

Three Simple Reasons to use a Property Finder....

Buying Turkish Property- Why use an Eksper Rapor ?

Are Appraisal Valuations in Turkey Understating Property Prices?

Independent Legal Advice for Property Purchases in Turkey

‘Reservation Deposits’ for Property Purchases in Turkey…

Property Purchase Disputes in Turkey- Re-claiming Reservation Deposits

What is 'Conveyancing' and why is it essential?

When or When Not to use a Solicitor for Property Matters in Turkey

Keep informed about property matters in Turkey, with articles like this one…sign-up for our periodic Newsletter by email...

Inquire today to learn more by email to info@mytapu.com with the subject line

'CBI Financial Assets' and include a WhatsApp or Viber number to receive a complimentary call back…

At mytapu.com our policy is to ensure our clients are fully informed, so that they may make fully informed decisions- this helps to ensure better outcomes all around.

Building Trusted Relationships is Building Our Business...!