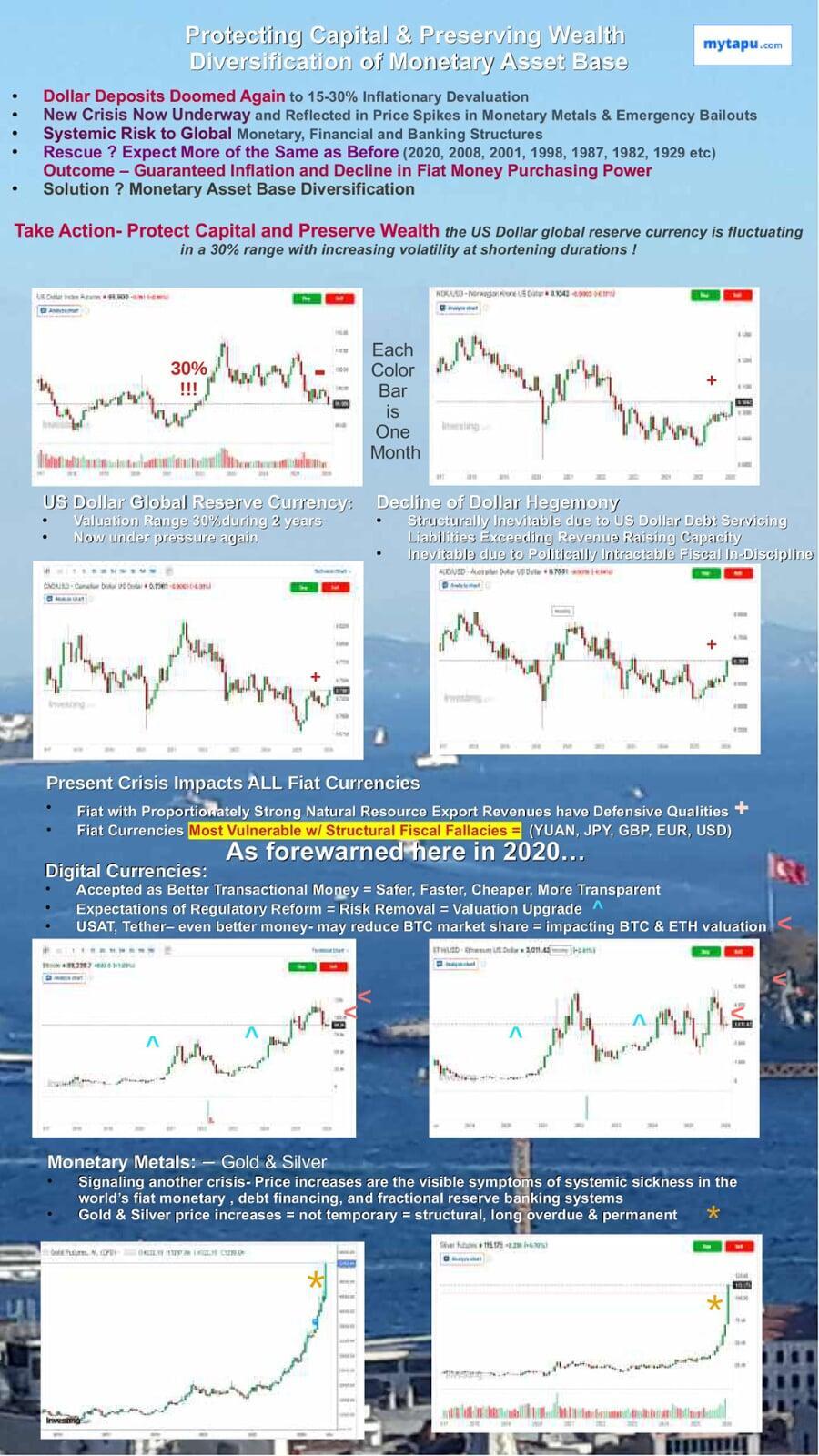

Take Action- in this era where the US Dollar global reserve currency is fluctuating in a 30% range with increasing volatility at shortening durations.

Protecting Capital & Preserving Wealth

by

Diversification of Monetary Asset Base

Key Points of Unfolding Crisis…

All Dollar & Fiat Deposits Doomed Again to Inflationary Devaluation: Expect 15-30% over next two years

- New Crisis Now Underway and Reflected in Price Spikes in Monetary Metals

- Systemic Risk to Global Monetary, Financial and Banking Structures

- Rescue ? Expect More of the Same as Before

- Emergency Liquidity Funding Bailouts Already Underway

- The Results Will Be Same as Before

- With Increasing Volatility and Shorter Durations

- Outcome – Guaranteed Inflation and Decline in Fiat Money Purchasing Power

Why is Managing their Monetary Base is THE PRIORITY for Investors ?

The pool of capital from which an investor draws funds to invest, is referred to as ther investor’s ‘Monetary Base'. In the present era during the final stages of the ongoing fiat money cycle & collapse (the 'Great Reset') , the number one priority for investor’s is to position their monetary base defensively to protect capital and preserve wealth. Analysing investment opportunities is a secondary priority, because in the present era the volatility in monetary base assets can produce losses that exceed profit returns in other assets, like real estate, fixed income bonds, stock equity, and alternative assets classes.x

Defend Against Devaluation with Diversification

Diversification of the Monetary Base is Defensive Strategy for Protecting Capital & Preserving Wealth. The charts of the US Dollar index below clearly show this present risk with the US Dollar having fluctuated in a 30% range during previous years. A longer term view of the shows the US Dollars has declined even more over a longer term … see here… Managing the Diversification of Assets is Essential for Defending the Purchasing Power of Capital Wealth.

Advisory Services for Managing the Diversification of the Monetary Asset Base

The principals of MyTapu Associates have been managing capital protection & wealth preservation for investors since the early 1980’s. and provide the following advisory services for investors:

Planning Monetary Base Diversification

Essential before Financial Planning and before Investment Analysis of Real Estate, Fixed Income, Equities, and Alternative Asset Classes

Implementing Diversification

- Assessment of Existing Service Providers and Products

- Opening Accounts with New Service Providers

Instructing Service Providers

- Management of Diversification Process and Procedures

Managing & Monitoring

- Research, Tools, Guidance, Performance, Reporting

Economics Research

The analysis in the image below is part of that ongoing service, which includes the research from our Chief Economist (see below).

A brief look at key points from the more detailed Economics Research shown in the image, follows below.

Services Description: Learn more about the above services, how they may be integrated with Turkiye’s Citizenship Investment Program ( CIP / CBI ), or integrated with an investors existing banking service providers, by requesting ‘Monetary Asset Base Diversification Services’ here or directly by email to info@mytapu.com.

Detailed Analysis: Read the full analysis of the above by Requesting ‘ Crisis Analysis' ;here or directly by email to info@mytapu.com.

Weekly Updates:Request the Weekly Update newsletter with Asset Allocation directions and guldance, and performance monitoring

by Requesting ‘ MABD Weekly Update' here or directly by email to info@mytapu.com

.

What’s it All About ? The Silver Crisis, Monetary Assets, and Global Banking System…

Key Points- Present Crisis Environment

Evolution of Monetary Assets Since Previous Crisis in 2020

- Crypto /Digital Currencies Proven Superiority as Transactional Money (Medium of Exchange)- faster, cheaper, safer, and with improved data management integratations, enabling very large cost savings for financial services providers,etc

- Regulatory Risk removal in Progress with US Genius Act

- BTC BitCoin positioned as Leader for Consumer and B2C Transactional Exchanges

- USAT and additional Tether solutions positioned as first fully Federally recognized and regulated digital currency may reduce BTC market share

- USAT, UST, USD Support Longer Duration for Dollar Hegemony

- ETH Ethereum positioned as Leader for Emerging New Banking De-Fin Sector

Decline of Dollar Hegemony

Structurally Unavoidable due to US Dollar Debt Servicing Liabilities Exceeding Revenue Raising Capacity

- Inevitable due to Politically Intractable Fiscal In-Discipline

Present Crisis Applies to ALL Fiat Currencies

- Fiat Currencies Most Vulnerable: those with Fiscal Fallacies Imbedded Structurally with severe asset/liability funding duration risk mis-matches (YUAN, JPY, GBP, EUR, USD)

Fiat Currencies with Defensive Qualities

Proportionately Strong Natural Resource Export Revenues

- Fiat Currencies with Lower Risk Profiles NOK, AUD, CAD

- Fiat Currencies with Higher Risk Profiles are Less Shock-Insulated & Excluded

As forewarned here in 2020… see here…

Once again now, the US Dollar is under pressure, may crack key long-term price support level,…

- but also likely shall experience periods of lesser pessimism and temporary bounce backs due to:

- New US trade tariff and hemisphere resource sequestration regime

- Structural impact of Tether USAT,UST, USD

- Un-foreseen new central banking system tools

- Positive impact on US Capital Account and inflows attracted by US on-shoring policy priorities.

Precious Metals Monetary Asset Prices

Signaling another crisis in the world’s monetary and banking systems.

- Price increases are visible sign of symptoms of sickness in the fiat money, debt financing, and fractional reserve banking system that dominates the world.

- Increases in Gold & Silver are not temporary or short lived, but instead are structural, due to three decades of downward manipulation of monetary metals (Gold and Silver) prices by the global central bank monopoly and it’s surrogate commercial banks.

Price Spikes not Temporary

Market rumors of silver price (XAG) increase as the present one to four month short squeeze threatens contract and systemic default range from the present price of $100 per ounce to a range of $200- $600 and with out accurate supply/demand priced discovery modeling could be expected during speculative excess to exceed this level by multiples.

To place the present gold (XAU) price in context of comparative economic data, consider the total US government obligations and liabilities are estimated at $ 300 Trillion, with the US Government Treasury Bond debt alone at $38 Trillion, a revaluation of gold to collateralize that latter number prices gold at $200,000 per ounce from its current price of $5,000.

Price Volatility

Perhaps that $200,000/ounce price serves as a benchmark at the lower end of a target range for Gold. If one considers the original reasons why Gold served as a backing for paper currency, the upper end of the range is considerably higher. Fifty years ago the US Dollar was exchangeable for physical Gold. That physical backing was removed, and if the reasons for Gold-backing once again became necessary, the upper price limit for Gold would be many multiples higher, The amount of US Treasury bond debt of $ 38 trillion is a much smaller number than the total value of us dollars in circulation, considering the total amount of debt obligations of the US government and it’s agencies is estimated at $ 200 trillion, and is thus 5x more than US Treasury bonds, a Gold price of $ 1,000,000, 200x higher then it’s current price, inconceivable ? The answer, is the reason, why the concept of the ‘Great Reset’ has become talked about incessantly during the last five years.

Manipulating Perceptions to Manipulate Prices

The downward price manipulation of monetary metals since the price spikes of late 1970’s and early 1980’s has been essential to maintain the pretence of security, trust and value in paper currency and digital credit, and the un-sustainable low quality economic growth fueled by cheap debt and manipulated price of credit / interest rates.

Proof of Manipulation

There is neither question nor doubt that the commercial banking surrogates of the central banking monopoly have been manipulating prices. During the last few decades there have been numerous guilty verdicts delivered in the US and UK. The banks have paid huge fines, and the traders have been banned and otherwise sanctioned. The practice occurs not only in Gold pricing but also in interest rate pricing. Guilty verdicts for the manipulators of the London Inter Bank Offered Rate (Libor) in recent years are the reason why Libor has disappeared from being the key most important interest rate in the global financial system- a monumental occurrence that scarcely receive any media coverage. The huge fines the banks pay for manipulating prices are just a trifle in the context of being essential to control the global financial system

Paper vs Physical

At the crux of the present crisis, is the key issue of manipulation, enabling price discovery fraud, resulting in contract default. The decades of Gold and Silver price manipulation has resulted in extreme demand & supply imbalances, pushing markets to the brink of contagion and collapse, as the paper futures contracts for Silver delivery that trade on global exchanges and represent the physical price, can not be delivered. The paper futures contracts may naturally be expected to converge towards zero, as their value is eradicated by delivery default. The system that is built around these contracts, relies on the trust the contracts will be honoured, and that trust in the system will also be destroyed. Loss of trust is contagious and increases risks of spreading through-out the system This contagion is a feature of every systemic crisis. The resulting volatility is then impacted by a bi-furcated price discovery dynamic, as the paper contract prices crash, the physical metals prices increase in large, scarcely believable, daily increments, likely to many multiples of the current price.

The ‘Great Reset’

The ‘Great Reset’ is about who controls that re-pricing of scarcity, until such time as the demand and supply imbalance is stabilized, which under current circumstances for Silver, is unlikely to be adjusted by product substitution and new mine supply in less than 18 months to two years – far too long in present conditions requiring delivery within 3-6 months.

Manipulating Prices Inevitably Fails

Managing this situation by the bankers might have struggled along at politically acceptable levels for few more years of indulgence, were it not for the innovation in new technologies that spurred growth in new emerging economic sectors that led to a sharp increase in demand far exceeding supply for strategic minerals, including industrial uses for monetary metals: nickel, copper, gold, and silver, the latter having the most severe demand & supply imbalance. Manipulating Prices Inevitably Fails, yes that time has arrived..

History repeats the process of fiat money depreciation... see here…

.... undermining the hegemony of the existing, present-day’s most trusted and strongest fiat money currency (USD), which in today’s global fractional reserve system is held as reserved and thus referred to as the ‘ reserve’ currency, because it provides the core collateral securing new debt issuance.

The repetition of the boom-bust cycle is always the same…

Issuing new debt to create liquidity to produce economic growth.

- This new growth hurriedly mis-allocates resources to sectors and investments having lesser sustainability and economic yield than more carefully selected investments that produce innovations that spur more valuable growth..

- The debt fueled boom, inevitably leads to dependency on cheap credit to fuel economic activity, and over-leveraged financial sectors, leading to bust.

- Every new wave of debt creates new economic activity of shorter duration and larger volatility in asset values.

- Reliance on debt financing creates an addiction dependency abused by democratic governance systems, as politicians abuse government debt system to buy votes and thus power.

The sequence of steps is always the same…

- Diminished impact of previous debt funding liquidity on economic activity.

- Deflationary price pressure undermining debt servicing and repayment

- Credit crisis in a specific segment of the system

- Sharp decline in asset values and prices...

- Liquidity funding provided as an emergency.

- Investment asset price inflation.

- General price inflation.

- Surge in economic growth that is temporary, followed by declining economic growth.

- Slowing growth results in reduced debt servicing capacity…

- Deflation results unless a new fix of new money to create new debt to earn interest to cover the burden of previously un-performing debt.

- Volatility of asset prices increase at simultaneously with the faster repition of the cycles over shorter time periods…

- Crack-Up Boom-Bust results from systemic stress between the contra flowing inflationary and deflationary dynamics

- End of fiat money cycle

- Reserve currency displacement

This has happened multiple times over the last few hundred of years... nothing new !!! Nothing unexpected !!!

This is how and why investors that do not defend their monetary base with diversification will be left with vastly diminished capital and wealth… and it is not an investment practice – it is monetary management.

Detailed Analysis: Read the full analysis of the above by Requesting ‘ Crisis Analysis' ; here or directly by email to info@mytapu.com.

Weekly Updates: Request the Weekly Update newsletter with Asset Allocation directions and guldance, and performance monitoring

by Requesting ‘ MABD Weekly Update' here or directly by email to info@mytapu.com

Economics Research

Please contactinfo@MyTapu.com for further information today, about Price Risk Analysis.

The specialists at MyTapu associates are qualified, licensed, experienced investment advisors, The Value of Trusted Investment Advisor has never been greater, and does not include ad-hoc advice from unqualified citizenship consultants, real estate agents. property lawyers, bankers, etc - these are not qualified investment advisors.

Additional Reading- Articles and Web Pages...

Please contactinfo@MyTapu.com for further information today, about Price Risk Analysis.

The specialists at MyTapu associates are qualified, licensed, experienced investment advisors, The Value of Trusted Investment Advisor has never been greater, and does not include ad-hoc advice from unqualified citizenship consultants, real estate agents. property lawyers, bankers, etc - these are not qualified investment advisors.

- Read more details in articles...

Every property owner in Turkiye has a tapu, and that is why we named our business my tapu...

At mytapu.com our policy is to ensure our clients are fully informed, so that they may make fully informed decisions- this helps to ensure better outcomes all around.

Building Trusted Relationships is Building Our Business...!